-

Celebrity News1 week ago

Celebrity News1 week agoMiley Cyrus’ Boyfriend Maxx Morando Believes the Singer ‘Hasn’t Fully Let Go’ of Ex Liam Hemsworth

-

Celebrity News1 week ago

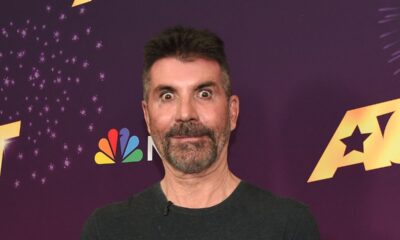

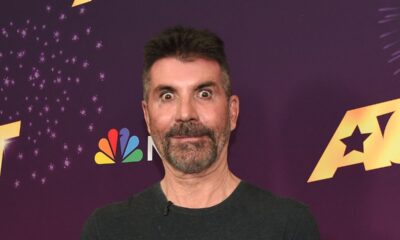

Celebrity News1 week agoSimon Cowell Admits He Turned Down ‘A Lot of Money’ By Refusing to Judge a Couple’s Unusual Proposition

-

Celebrity News1 week ago

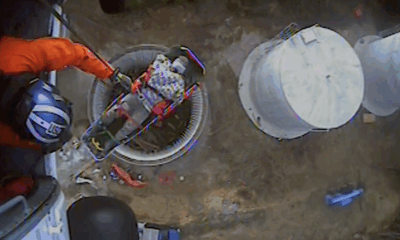

Celebrity News1 week agoGolf Legend Greg Norman Talks Cheating Death After His Windshield Shattered During Private Flight

-

Celebrity News1 week ago

Celebrity News1 week agoNews Flash: Morgan Wallen’s Exit Explained, Kendra Wilkinson’s Playboy Confession and More

-

Celebrity News1 week ago

Celebrity News1 week agoHollywood Hookups: Tyler Henry Weds, Cardi B Scores With Stefon Diggs & Sean Murray’s Marriage Ends

-

Celebrity News1 week ago

Celebrity News1 week agoPom Klementieff Dares to Impress, Felicity Jones Glows in Organza & Drew Barrymore Suits Up in Style

-

Celebrity News5 days ago

Celebrity News5 days agoBethenny Frankel’s Palm Beach Dream Hits a Snag as Socialites Reportedly Keep Their Distance

-

Celebrity News5 days ago

Celebrity News5 days agoMichael J. Fox Stages Remarkable Comeback with ‘Shrinking’ Role After Years of Health Struggles

-

Celebrity News4 days ago

Celebrity News4 days agoJustin Bieber Sells Entire Music Catalog for $200 Million as Financial Woes Push Him to the Brink

-

Celebrity News5 days ago

Celebrity News5 days agoKathy Griffin Skips Joan Rivers Tribute While Comedy’s Biggest Names Show Up to Honor the Legend

-

Celebrity News5 days ago

Celebrity News5 days agoKim Kardashian Testifies in French Robbery Trial — and Turns the Courtroom Into a Reality TV Set

-

Celebrity News3 days ago

Celebrity News3 days agoTommy Lee’s Marriage to Brittany Furlan Ends as The Rocker Struggles With Sobriety and His Bond With Pamela Anderson