-

Celebrity News6 days ago

Celebrity News6 days agoKourtney Kardashian Caught in the Middle as Exes Scott Disick and Travis Barker Refuse to Play Nice

-

Celebrity News4 days ago

Celebrity News4 days agoThe Gayle King-Starring ‘CBS Mornings’ Face All-Time Low Ratings Amid Brutal Cost-Cutting Measures

-

Celebrity News3 days ago

Celebrity News3 days agoBarack & Michelle Obama ‘Barely Even Talked’ During Very Public Dinner Outing in Washington D.C.

-

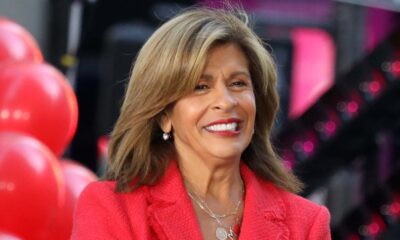

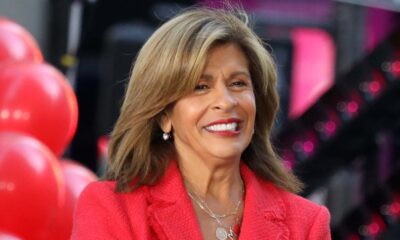

Celebrity News5 days ago

Celebrity News5 days agoHoda Kotb In Talks For Daytime Talk Show, Taking Over Kelly Clarkson’s Spot Following ‘Today’ Exit

-

Celebrity News4 days ago

Celebrity News4 days agoFormer ‘Good Morning America’ Meteorologist Rob Marciano Struggling to Find Camaraderi at CBS

-

Celebrity News6 days ago

Celebrity News6 days agoJennifer Garner Rekindles Romance With John Miller, But Still Has Cold Feet Over Engagement Plans

-

Celebrity News5 days ago

Celebrity News5 days agoBruce Willis’ Family Struggles With Fallout as Wife Emma Prepares to Release Personal Memoir on His Dementia Battle

-

Celebrity News5 days ago

Celebrity News5 days agoArchaeologist Claims To Have Solved Amelia Earhart Mystery With Stunning Pacific Discovery

-

Celebrity News3 days ago

Celebrity News3 days agoScreen Legend Carol Burnett Showing Tough Love to Troubled Grandson as He Struggles to Stay Afloat

-

Celebrity News6 days ago

Celebrity News6 days agoJennifer Lopez Refuses to Budge as Ben Affleck Begs to Slash Price on Their $68M Lavish Beverly Hills Estate

-

Celebrity News4 days ago

Celebrity News4 days agoBruce Springsteen Following Doctor’s Orders as He Embarks on European Tour Amid Health Recovery

-

Celebrity News6 days ago

Celebrity News6 days agoScarlett Johansson Awkwardly Avoids Ex Ryan Reynolds and Blake Lively at Glamorous Time 100 Gala