Shutterstock

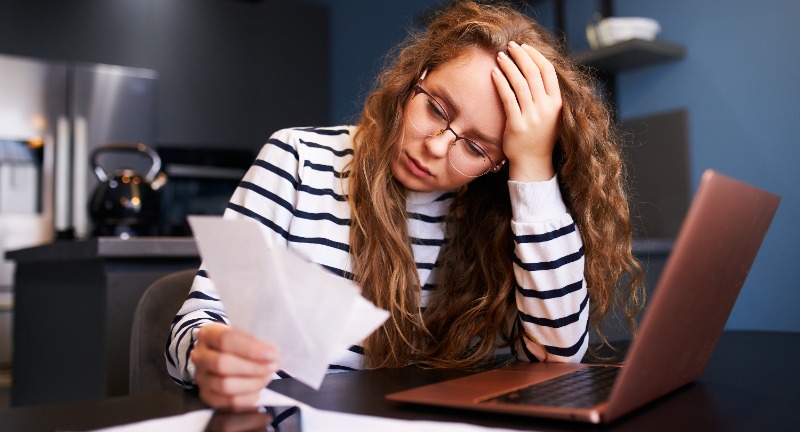

Life is full of surprises, and not all of them are pleasant. Events likea major car repair, a sudden job loss, or an unexpected medical bill can turn your finances upside down in an instant. Without a safety net, these unforeseen expenses can lead to debt, stress, and a downward spiral that’s hard to escape. This is why having an emergency savings fund isn’t just a good idea, it’s a financial necessity.

Let’s explore 21 compelling reasons why an emergency fund is crucial to securing your financial well-being.

Unexpected Medical Expenses

Shutterstock

Medical emergencies can strike without warning, leaving you with hefty bills that insurance might not fully cover. An emergency savings fund ensures that you can afford necessary treatments, medications, and follow-up care without sacrificing your financial health. This financial cushion allows you to focus on recovery rather than worrying about how to pay the bills. In the long run, it also helps you avoid the stress and burden of medical debt.

Job Loss Protection

Shutterstock

Losing your job can be a significant blow, both emotionally and financially, as it disrupts your regular income stream. With an emergency savings fund, you have the security of knowing that your basic living expenses—like rent, groceries, and utilities—are covered while you search for new employment. This buffer gives you the time and space to find a job that suits your skills and needs rather than rushing into a less-than-ideal position out of financial desperation. Ultimately, it helps preserve your long-term career trajectory and financial stability.

Car Repairs

Shutterstock

Vehicles are indispensable for most people, providing essential transportation for work, school, and daily errands. When your car suddenly breaks down, repair costs can be both unexpected and expensive. An emergency fund ensures that you can cover these repairs without disrupting your budget or needing to rely on costly credit options. By keeping your car in good working condition, you maintain your mobility and avoid the added stress of being without transportation.

Home Repairs

Shutterstock

Your home is likely your most significant investment, and maintaining it is crucial to your comfort and safety. Unexpected issues, like a broken furnace in winter or a leaking roof during a storm, can quickly escalate into costly problems. An emergency savings fund allows you to address these repairs promptly, preventing further damage and ensuring your home remains a safe haven. This proactive approach not only protects your property but also helps you avoid the high interest associated with financing these repairs through loans or credit cards.

Unexpected Travel Costs

Shutterstock

Life’s emergencies don’t always happen close to home; sometimes, you need to travel unexpectedly for a family crisis, a funeral, or to support a loved one. An emergency fund gives you the financial freedom to book last-minute flights, accommodation, and other travel-related expenses without compromising your budget. This flexibility ensures that you can be there for the people who matter most when they need you the most. Moreover, it prevents the added emotional stress of financial concerns during already difficult times.

Pet Emergencies

Shutterstock

Pets are family, and just like humans, they can experience sudden health issues that require immediate medical attention. Veterinary bills, especially in emergencies, can be surprisingly high, and not all pet insurance plans cover everything. An emergency savings fund ensures you can provide your pets with the care they need without hesitation or financial strain. This way, you can focus on helping your furry friend recover rather than worrying about the costs involved.

Natural Disasters

Shutterstock

Natural disasters like hurricanes, floods, and earthquakes can cause devastating damage to your home and possessions. While insurance may cover some costs, it often doesn’t account for everything, and the immediate expenses can be overwhelming. An emergency fund provides quick access to the money you need to repair, rebuild, or replace essential items in the aftermath of a disaster. Having this financial backup ensures that you can recover more quickly and begin restoring normalcy to your life.

Peace of Mind

Shutterstock

Financial stress is one of the leading causes of anxiety, and not having a safety net can exacerbate this stress in times of uncertainty. An emergency savings fund offers peace of mind by providing a financial buffer against life’s unexpected challenges. Knowing that you have money set aside for emergencies allows you to approach life with greater confidence and less worry. This sense of security contributes to overall mental well-being and helps you focus on long-term financial goals.

Avoiding Debt

Shutterstock

When faced with unexpected expenses, many people turn to credit cards or loans, which can lead to mounting debt and high interest payments. An emergency savings fund prevents you from falling into this cycle by providing the funds you need without borrowing. By avoiding debt, you protect your credit score and save money in the long run, as you won’t be paying interest on emergency-related expenses. This financial independence ensures that your future income can go toward building wealth rather than servicing debt.

Supporting Family Members

Shutterstock

Family emergencies, such as a sudden illness or financial crisis, can place a significant burden on your loved ones. Having an emergency fund allows you to step in and offer financial support without jeopardizing your financial stability. Whether it’s covering medical bills, helping with rent, or providing temporary financial relief, your emergency savings can make a crucial difference. This ability to help without risking your own security strengthens family bonds and provides mutual support during difficult times.

Covering Living Expenses During Illness

Shutterstock

If you become ill and are unable to work, your regular income may be interrupted, making it difficult to cover daily expenses. An emergency savings fund ensures that you can pay for essentials like housing, food, and utilities while you recover. This financial support allows you to focus on getting better without the added worry of falling behind on bills. In the long term, it helps you avoid the financial fallout that often accompanies prolonged illness or disability.

Sudden Rent Increases

Shutterstock

Rent can sometimes increase unexpectedly, especially in a competitive housing market, leaving you scrambling to cover the higher costs. An emergency fund gives you the flexibility to manage these increases without needing to move or cut back on other essentials. This financial cushion allows you to maintain your current living situation while you assess your options, such as negotiating with your landlord or finding a new place to live. In the end, it helps you avoid the disruption and costs associated with an unplanned move.

Legal Expenses

Shutterstock

Legal issues, such as disputes, divorces, or custody battles, can be both emotionally and financially draining. An emergency savings fund provides the resources needed to cover legal fees, court costs, and other related expenses without compromising your financial stability. By having funds available, you can secure quality legal representation and protect your interests effectively. This financial preparedness ensures that you can navigate legal challenges without the added stress of unexpected costs.

Unexpected Utility Costs

Shutterstock

Utility bills can fluctuate, especially during extreme weather conditions, leading to unexpected spikes in costs. An emergency fund helps you manage these higher-than-expected bills without disrupting your budget or falling behind on payments. By having money set aside for such occurrences, you avoid the risk of utility shutoffs or the need to divert funds from other essential expenses. This financial flexibility ensures that your home remains comfortable and functional, regardless of the season.

Temporary Business Downturns

Shutterstock

For business owners or freelancers, income can be unpredictable, with periods of high earnings followed by slow times. An emergency fund acts as a financial bridge, covering personal expenses during these downturns and ensuring your household remains stable. This cushion allows you to continue focusing on growing your business or finding new clients without the immediate pressure of financial strain. By smoothing out the highs and lows, an emergency fund helps you maintain a consistent standard of living.

Maintaining Lifestyle Stability

Shutterstock

Life is full of surprises, and sometimes unexpected events can threaten your ability to maintain your current lifestyle. An emergency savings fund allows you to handle these surprises without making drastic changes to your daily life, such as cutting back on necessities or altering your routine. By providing a financial buffer, your emergency fund helps you navigate life’s ups and downs with minimal disruption. This stability is crucial for maintaining your mental and emotional well-being during challenging times.

Protecting Retirement Savings

Shutterstock

Dipping into retirement savings to cover emergencies can derail your long-term financial goals and reduce the compounding benefits of your investments. An emergency fund acts as a first line of defense, allowing you to address immediate financial needs without touching your retirement accounts. By preserving your retirement savings, you ensure that your future financial security remains intact. This approach helps you stay on track to meet your retirement goals, giving you peace of mind for the years ahead.

Avoiding Payday Loans

Shutterstock

Payday loans might seem like a quick fix in a financial emergency, but they come with high-interest rates and can trap you in a cycle of debt. An emergency savings fund eliminates the need for these risky loans, providing the funds you need without the exorbitant costs. By avoiding payday loans, you protect your financial health and prevent future financial difficulties. This strategy ensures that your hard-earned money is spent wisely and not wasted on unnecessary interest payments.

Managing Inflation and Rising Costs

Shutterstock

Inflation can erode your purchasing power, leading to higher costs for everyday goods and services. An emergency fund provides a financial buffer to help you manage these rising costs without immediately feeling the pinch. This reserve allows you to adjust your budget gradually and avoid making hasty decisions that could affect your long-term financial well-being. By preparing for inflation, you protect your lifestyle and financial security against the unpredictable nature of the economy.

Handling Tax Surprises

Shutterstock

Tax season can sometimes bring unexpected surprises, such as owing more than you anticipated or facing an audit. An emergency fund ensures that you can cover these tax liabilities without incurring penalties or needing to set up a payment plan. This financial readiness allows you to address tax issues promptly and avoid the stress and costs associated with delayed payments. By having funds set aside, you can navigate tax season with confidence and peace of mind.

Building Financial Confidence

Shutterstock

Having an emergency fund gives you the confidence to face life’s challenges head-on, knowing that you have the financial resources to handle whatever comes your way. This financial safety net empowers you to make informed decisions, take calculated risks, and pursue opportunities without the constant fear of financial ruin. By building and maintaining an emergency fund, you enhance your overall financial well-being and set the stage for long-term success. This confidence is a crucial component of a healthy and balanced financial life.

Conclusion

Shutterstock

In a world filled with uncertainties, an emergency savings fund is your financial lifeline, offering protection against life’s unexpected challenges. Whether it’s a sudden expense, a job loss, or an economic downturn, this fund ensures you’re prepared to navigate rough waters without sinking into debt. By building and maintaining an emergency fund, you safeguard not only your finances but also your peace of mind. It’s a small investment in your future that pays off in resilience and security. Start saving today, and give yourself the confidence to face whatever comes your way.

Entertainment3 weeks ago

Entertainment3 weeks ago

Celebrity News5 days ago

Celebrity News5 days ago

Celebrity News5 days ago

Celebrity News5 days ago

Celebrity News1 month ago

Celebrity News1 month ago

News5 days ago

News5 days ago

News6 months ago

News6 months ago

Entertainment2 months ago

Entertainment2 months ago

Celebrity News3 weeks ago

Celebrity News3 weeks ago